Power measuring transducer is a simple and reliable way to measure wattage, whether for one motor, one machine, or an entire building. The output signal allows you to monitor the power used and report the use to a website, a local display, or to be used to send alarms when the power rises to abnormal levels or falls to unexpected levels.

Power Measuring Transducer,Busway Temperature Sensor,Current Voltage Traunsducer,Power Frequency Transducer Jiangsu Sfere Electric Co., Ltd , https://www.elecnova-global.com

As China’s broadcasting industry takes cable digital TV as the development focus of the entire industry, the growth rate of cable digital TV smart cards is faster, and in addition, some digital TV users will increase the number of second and third terminals, which will bring a second, The purchase of the third smart card will bring more room for market growth. In addition, with the continuous deepening of the two-way network reform, CAS development in the future will adapt to the two-way network operating environment, and operators of radio and television will pay more attention to the security performance of the two-way network.

As of the third quarter of 2014, China’s cable network operators began to uniformly use terminal equipment such as CAs and set-top boxes on the basis of provincial-based regional network integration. Provinces and cities that have unifiedly used CA systems accounted for 96.19% of the total. The provinces and cities that have not unifiedly used the CA system accounted for 3.81% of the total, of which the typical provinces are: Hebei Province, Inner Mongolia Autonomous Region, Jilin Province, Hunan Province, part of the Internet company, Guangxi Zhuang Autonomous Region, Shaanxi Province, Ningxia Hui Autonomous Region.

As of the third quarter of 2014, China’s cable digital TV industry operators are currently issuing 13 CA system smart card competitors. The most important vendors are: Yongxin Vision, SkyView, Digital Video, Irdeto. , NDS, Conax, etc.

Table 1: Major CA System Competitors in China's Cable Digital TV Industry

Serial No. Company Name Country Major Products and Models 1 Yongxin Visionbo China Yongxin Vision Conditional Reception System V2.1Pro, Vision Conditional Access System V3.0

2 Yunshi (Tianbai) China Tianzhu Receiver V5.0

3 Digital Video China StreamGuard CAS Digital TV Conditional Access System V5.1

4 Irdeto Netherlands Digital Video Broadcasting Conditional Access System KMS (V3.2.1.0)

5 Conax Norway Conax CAS7 System 6 Nagra Switzerland Nagravision2 FAQ v0.3

7 NDS United Kingdom NDS VideoGuard CA1

8 Sanzhou Centrino China Sanzhou Centrino Digital TV Conditional Access Software (V4.0)

10 Wuhan Dongtai China Digital Television Conditional Access System (DT-CAS)_3

11 Oriental Vision China Digital TV Broadcast Condition Receiving System V3.0

12 Calculations China CTI_CAS Calculated Digital Conditional Access System V3.0

13 Digital Taihe China UDRM Digital Rights Management System

At present, the competition pattern of the domestic CA system market is relatively concentrated: Yongxin TV, Yunshi Technology (Tianbai), and digital video have entered the market earlier, and the number of smart card issuance ranks first, and the market share is relatively high. The development of other manufacturers is relatively stable. In the future, the competition in the domestic conditional access system market will further intensify, extending from the provincial and municipal levels to districts and counties, from the first terminal to the second terminal. As of the third quarter of 2014, China’s cable digital TV CA system market was mainly divided by four companies, namely Yongxin Vision, Yunshi (Tianbai), Digital Video, and Irdeto. Local CA manufacturers have occupied most of the domestic market share, including Yongxin Bo covered 67.62% of the market in China's radio and television broadcasting system, followed by Yunshi (Tianbai), which covered 33.81% of the nation's radio and television broadcasting systems, and ranked third in digital video, covering 28.1% of the country's radio and television systems. The market, ranked fourth, is Irdeto, which covers 20.95% of the nation's radio and television broadcasting systems, and other branded CA systems cover relatively low cities.

Table 2: Number of Cities Covered by CA Digital Television Systems in China

No. Brand Coverage Number of Cities 1 Yongxin Vision Bo 142

2 Cloud Vision (Temba) 71

3 Digital Video 59

4 Irdeto 44

5 NDS 15

6 Conax 12

7 Calculations 8

8 Independent R&D 6

9 Nagra 4

10 Shandong Taixin 2

11 Other 4

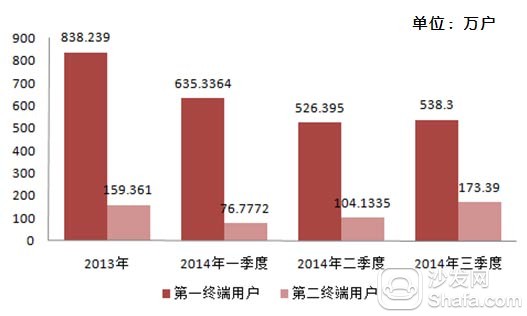

In the third quarter of 2014, China’s cable digital TV users increased by 7.19 million, China’s cable digital TV users reached 188.77 million, and China’s digital cable penetration rate reached 90.32%. The number of first-end users was 5.383 million, and the number of second-end users was 1,733,900, a slight increase from the previous quarter.

Table 3: Development Trends of Digital Cable TV Users in China

Project 2013 First Quarter of 2014 Second Quarter of 2014 Number of Cable Digital TV Subscribers in China (Million) in the Third Quarter of 2014 17086.3 17798.4136 18428.9421 18967.2421

Number of cable analog TV subscribers in China (million households) 3913.7 3201.5864 2571.0579 2032.7579

China's digital cable penetration rate (%) 81.36% 84.75% 87.76% 90.32%

Table 4: China's cable digital TV users: ten thousand households

Project 2013 First quarter of 2014 Second quarter of 2014 First end user in the third quarter of 2014 838.239 635.3364 526.395 538.3

Second end-user 159.361 76.7772 104.1335 173.39

In the third quarter of 2014, the number of smart cards issued by the China Cable Digital TV CA system reached more than 7 million (including cable networks, television stations, technology communication companies, and foreign companies), among which the CA system smart card manufacturers with the highest number of card is Yongxin TV, issuing cards. The volume accounted for 50.43% of China's cable digital TV CA system smart card issuance, followed by Yunshi (Tianbai), which accounted for 16.92% of China's cable digital TV CA system smart card issuance, and ranked third in digital video. The issuance volume accounted for 11.81% of China's cable digital TV CA system smart card issuance, followed by Irdeto, which accounted for 8.4% of China's cable digital TV CA system smart card issuance, and ranked fifth in NDS. The issuance volume accounted for 6.81% of China's cable digital TV CA system smart card issuance, and other brands CA system smart card issuance is relatively low.

Table 5: China's cable digital TV CA system smart card issuing unit:%

No. Brand The number of cards issued in the third quarter of 2014 1 Yongxin TV No. 3594550

2 Cloud Vision (Tmall) 1205650

3 Digital Video 841600

4 Irdeto 599000

5 NDS 485500

6 Other 400800

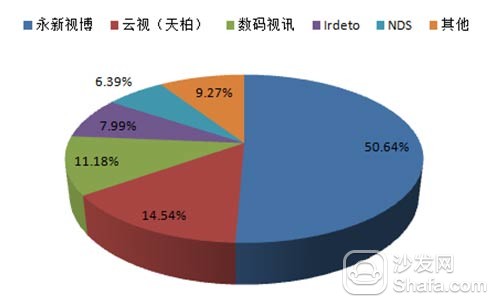

In the third quarter of 2014, China’s cable digital TV CA smart card manufacturers shipped more than 6 million cards, among which the manufacturers with more shipments were Yongxin Video, with more than 3.17 million shipments and occupied the digital TV CA smart card market. 50.64% of the market, followed by Yunshi (Tianbai) ranked second in terms of shipments, and 14.54% of the market for digital video CA smart cards, followed by digital video, which accounted for 11.18 of the digital TV CA smart card market. %, the manufacturer of foreign brands with more shipments is Irdeto, which accounts for 7.99% of the digital TV CA smart card market. Other brands have less shipments to the CA smart card market.

Table 6: Shipments of China's cable digital TV CA systems and smart card manufacturers Unit: %

No. Brands Shipments in the Third Quarter of 2014 1 Yongxin Vision Bo 317

2 Cloud Vision (Temba) 91

3 Digital Video 70

4 Irdeto 50

5 NDS 40

6 Others 58

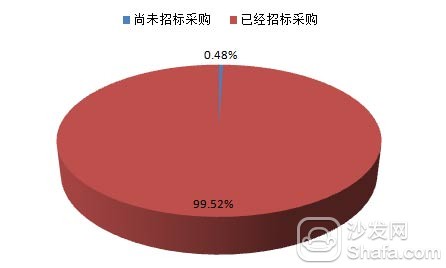

Figure 1: Whether Chinese Cable Network Operators Uniformly Use CA Systems

As of the third quarter of 2014, most of the cable network operators in China have chosen different brands of CA systems, and most of them have already completed bidding. Among them, the tender has been completed. In the short period of time, operators without a bidding plan accounted for 99.52% of the total market. Operators who have not built a CA system platform are relatively few, accounting for 0.48% of the total. These operators are basically characterized by small users. Similar to these smaller cities, many are currently choosing to integrate with the provincial network.

Figure 2: Bidding procurement of regional cable network operators CA system

9 Shandong Taixin China Taixin OPEN CAS V1.0

Figure 3: Coverage of cities covered by China's cable digital television CA system

Figure 4: Composition of China's cable digital TV users

Figure 5: The proportion of smart card issuance in China's cable digital TV CA system

Figure 6: Shipments of China's cable digital TV CA systems and smart card manufacturers

Recommended installation sofa butler, download address: http://app.shafa.com/