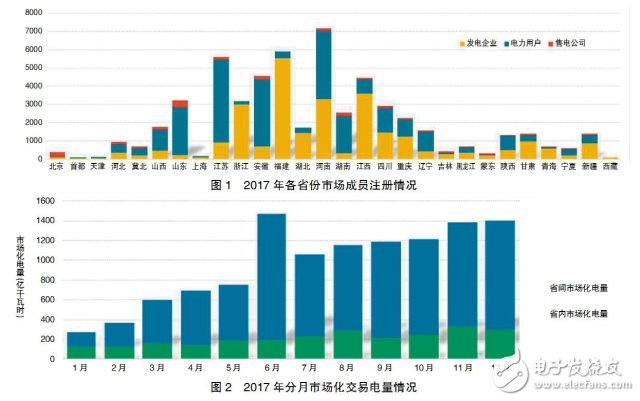

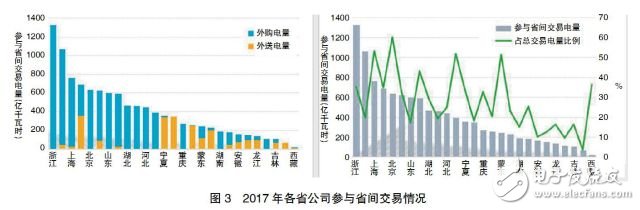

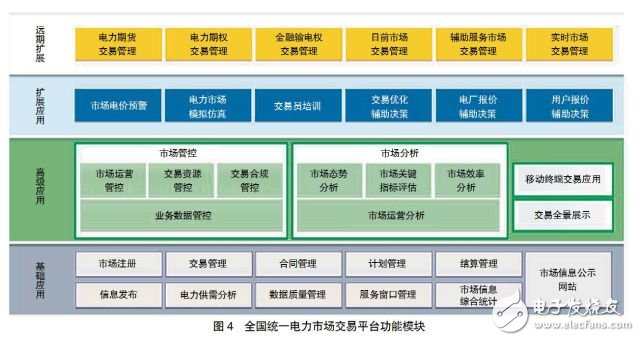

Since the issuance of the No. 9 document in mid-2015, according to the institutional structure of “management of the middle and release of the twoâ€, the construction process of China's electricity market has been accelerated, and a diversified market entity structure is taking shape, and the market subject consciousness is continuously enhanced. So far, all the 28 trading institutions in the national grid operating area have been set up, and an open and transparent trading platform has been set up. The number and scope of market participants have gradually expanded, the market-oriented trading volume has been rising, and the intra-provincial and inter-provincial trading varieties have become increasingly abundant. The level of clean energy consumption has continued to rise, and the reform dividend has gradually released and benefited the society. At the same time as the phased results of power market construction, China's power market still faces the grim situation that the market system is incomplete, the task of energy and low carbon transformation is arduous, and the scale of market-oriented transactions is continuously facing challenges. Therefore, in the next market operation, it is still necessary to effectively coordinate inter-provincial and intra-provincial transactions, coordinate mid- and long-term transactions and spot transactions, further enhance the power market risk prevention and control capabilities, strengthen the technical support of the power market, and develop a healthy and orderly development of China's electricity market. Lay a solid foundation. 2017 electricity market operations Judging from the current participation of market participants, as of the end of 2017, there were more than 55,700 registered members of the market in the national grid operation area, more than 27,000 power generation companies, and more than 26,000 power users, of which approximately 13,000 were retail. Users, another 13,000 other users are directly involved in the transaction; sales companies registered 2,233. In 2017, the number of registered power users and power-selling companies increased explosively, 3.7 times more than in 2016 (see Figure 1). In terms of total market transactions, the marketized trading power in 2017 exceeded 1 trillion kWh for the first time in the national grid region, reaching 1.2 trillion kWh, accounting for 31.2% of the total electricity sold by the national network. Nearly 900 billion kWh, the dividend was released by 29.5 billion yuan (see Figure 2). From the perspective of inter-provincial transactions and resource allocation, the total amount of inter-provincial power transactions in the country in 2017 was 873.5 billion kWh, of which the transaction volume and transaction scale of North China, Northeast China and East China increased rapidly, but the market share was the highest. In the region, more than 90% of market-based inter-provincial transactions have been achieved. The current transaction types are mainly divided into four categories, including inter-provincial contract transactions, direct transactions involving users and power companies, contract transfers and power generation transactions, and inter-provincial spot transactions. The price of inter-provincial market transactions was relatively stable in each month. With the tightening of supply and demand in the second half of 2017, the average landing price of market-based transactions in various provinces has increased simultaneously. From the perspective of intra-provincial transactions, the current intra-provincial transactions are mainly direct transactions involving direct participation by users or agents of sales companies. With the gradual liberalization of the power generation plan, direct electricity transactions in various provinces (except Tibet) have increased rapidly. The direct trade volume of power in Jiangsu, Shandong, Zhejiang, Henan, Anhui, Shanxi, and Sichuan provinces exceeded 50 billion kWh. The direct power of electricity in the four provinces of Liaoning, Fujian, Hubei and Shaanxi exceeded 30 billion kWh. Judging from the situation of new energy consumption, the new energy consumption reached a good level in 2017, achieving the goal of “double rising and double fallingâ€, in which both the abandoned power and the abandoned power rate were reduced, and the total amount of abandoned light abandoned. At 5.2 billion kWh, the rate of abandonment dropped from 16.3% to 11%. Judging from the sales business, there are already 15 provinces that allow sales companies to enter the market to participate in direct power transactions. According to statistics, more than 20% of the more than 2,000 power-selling companies registered have participated in market transactions, with a total of 210 billion kWh of electricity, accounting for 20% of the current market. Most of the power sales companies are still in their infancy and have not yet participated in market transactions (see Figure 3). The situation and challenges facing the power market Top-level design: The design and construction of a complete market system has become a top priority. At present, China's medium and long-term power transactions have matured over the years. All provinces have issued relevant rules for medium and long-term transactions in the province, established market models and conducted transactions. However, from the current situation, according to incomplete statistics, there are more than 300 trading rules in each province, and there are large differences between them. Judging from the deviation assessment of medium and long-term transactions, the scope of exemption assessment is 2%, and there are also various values ​​such as 3%; there are monthly assessments, and quarterly and annual assessments; there are also rolling adjustments. Pre-tag and other methods. In the case of a single intra-provincial market, there may be no contradictions. However, with the expansion of the market scope, especially the expansion of the scale of the inter-provincial market, as a power user, a power sales enterprise or a power generation enterprise, if you want to participate in the purchase and sale of electricity transactions between different provinces and provinces, you need to carry out the trading rules of the relevant provincial markets. In-depth understanding, the operation is more complicated, and the market players are more stunned. At the same time, this is not conducive to the interconnection and integration of the market, which is a clear constraint on the development of the national electricity market. At the same time, the country has identified eight provincial-level spot trading pilots as an important measure to further deepen the power market reform. There are six pilots in the China network region. Spot trading needs to be closely coupled with medium and long-term transactions, and must be coordinated and designed. Judging from the six spot trading pilots in the State Grid region, Zhejiang and Shanxi are currently making relatively fast progress, and the implementation plan at the operational level has been initially proposed. Judging from the pilot program of the spot market construction, several pilot units in the spot market have huge differences in market models, trading organizations, and transaction settlement. Therefore, the next step in the construction of the electricity market should be as detailed as possible at the top-level design level, and the overall design of the market system should be carefully designed to promote market construction, so as to better promote the free flow of resources and clean energy consumption, and facilitate market participants to participate in transactions. To prepare for future market integration. Clean transformation: The task of promoting low-carbon energy transformation is still arduous. Since the 18th National Party Congress, General Secretary Xi Jinping has repeatedly proposed to promote the four revolutions of energy and a cooperation. Especially at the Central Economic Work Conference held at the end of last year, General Secretary Xi clearly called for speeding up the construction of the electricity market, greatly improving market-oriented transactions and promoting clean substitution. Promoting clean energy consumption through market mechanisms is an important measure to implement the requirements of the Party Central Committee and the State Council, and it is also an issue that must be considered in any current power market. Although the wind power and solar power abandonment and abandonment rate in China have achieved double decline in 2017, the consumption of clean energy is still insufficient, and the installed capacity is still growing rapidly. The clean energy consumption is still under tremendous pressure. generator Clean energy, especially new energy, has the characteristics of difficult prediction and strong volatility. From the current situation, the solution to clean energy consumption is mainly through two measures. On the one hand, it strengthens the construction of “hardwareâ€, coordinates the planning and construction of power grids, and actively promotes the construction of UHV trans-regional transmission channels and system peak shaving capacity. The power grid balance adjustment capability promotes the coordinated development and friendly interaction of the source network. On the other hand, strengthen the construction of “softwareâ€, improve the power market mechanism, and effectively coordinate the interests of clean energy and conventional energy and related parties through the market. Promote the improvement of investment and consumption incentives, promote the substitution of electric energy, and fully mobilize the enthusiasm of the whole society to use more clean energy. Market Dividend: The challenge of continuously expanding the scale of market-oriented transactions. 2018 is the 40th anniversary of reform and opening up. At the two sessions this year, Premier Li Keqiang put forward the requirement that the general industrial and commercial electricity price will drop by 10%. All sectors of the society have given high expectations for accelerating market construction, further expanding the scale of market transactions, and promoting the release of dividends. At present, the scale of liberalization of various provinces and regional markets is not the same. From the preliminary plan of 2018, the coverage of the national grid, Qinghai The ratio of opening is the highest, exceeding 60%; the proportion of Shanxi, Jiangsu, Gansu, Ningxia, and Xinjiang is more than 40%; the ratio of Anhui, Fujian, Henan, Liaoning, Mengdong, Shaanxi, Sichuan, and Chongqing is 30% to 40%; The proportion of Hebei, Shandong, Hubei, Jiangxi, Jilin, and Heilongjiang is 20% to 30%; the proportion of Shanghai, Zhejiang, and Hunan is 10% to 20%; the proportion of Beijing-Tianjin-Tangshan is less than 10%. In some regions, the task of expanding market transactions is heavier. Effective competition: effective competition in the market needs to be strengthened. From the overall operation of the electricity market in 2017: First of all, the competition in the market is still insufficient, especially the problem of inter-provincial barriers is prominent. Some provinces have strictly controlled the purchase of electricity outside the province, set the upper limit of purchased electricity, and lowered the electricity purchase outside the province. Problems such as price have restricted the role of the national electricity market and the full and efficient allocation of energy resources. Second, the market risk prevention and control mechanism needs to be improved. On the one hand, there are various risks such as price fluctuation, supply and demand balance, market power, and standardized operation in the market, which will affect the sustainable development of the market; on the other hand, the risk prevention mechanism of market entities is lacking, and the market credit system needs to be established. In particular, at present, China's power market is dominated by unilateral price reduction, and the purpose of users entering the market is to buy "cheap electricity." If supply and demand change, how to deal with the risk of rising electricity prices, this is a major test for the entire market and individual users, and there is currently no effective risk prevention measures. Therefore, the next step should give full play to the decisive role of the market in resource allocation, reduce market intervention, break down market barriers, promote the optimal allocation of power resources, and establish and improve market risk prevention and control mechanisms and information sharing mechanisms as soon as possible to promote effective market operations. . Thoughts and Ideas on the Development of China's Power Market In 2018, China's electricity market will be further deepened. With the advancement of the spot market pilot work, market construction will enter the deep water area, and there are three aspects that need careful consideration and detailed design. The first is the relationship between the inter-provincial market and the provincial market, the second is the relationship between the medium and long-term contract market and the spot market, and the third is the relationship between market transactions and grid operations. In the overall market design, the following key points need to be highlighted: first, how to prioritize the clean energy consumption and promote the clean and low-carbon transformation of China's energy; second, how to improve market transparency and build a fair competitive market environment; It is to establish a market risk prevention and control mechanism to ensure the healthy and sustainable operation of the market; Fourth, it is necessary to build a sound power market technical support platform to efficiently support the construction and operation of the electricity market. Coordinate inter-provincial and intra-provincial transactions. First, in combination with China's national conditions and development path, it is necessary to coordinate inter-provincial and intra-provincial transactions in accordance with the market model of “unified market and two-level operationâ€. The so-called "unified market" is to establish a national unified power market, have a unified market framework, operating platform, core rules, and coordinate operations to promote the optimal allocation of energy resources nationwide. Under the framework of the unified market, the operation is carried out by national and provincial trading platforms, with division of labor and cooperation, with different emphasis and close integration. From the perspective of inter-provincial and intra-provincial two-tier market positioning, the inter-provincial market is mainly positioned to optimize the allocation of energy resources, promote clean energy consumption, and implement national energy strategies; the positioning of the provincial market is to implement inter-provincial allocation results. On the basis of further optimization of provincial resource allocation, to ensure the balance of power and electricity in the province and the safe and stable operation of the grid. The second is to sort out the transaction timing, and the inter-provincial transactions are carried out earlier than the intra-provincial transactions. In other words, we will first optimize the allocation of resources across the country, and then balance the power and electricity in the province. Such transaction timing can link the inter-provincial and intra-provincial markets in an orderly manner, which not only ensures the implementation of the national energy strategy, but also helps ensure the balance of power balance. Third, in the settlement processing, the inter-provincial transaction is prioritized, and the deviation between the power generation side and the user side participates in the provincial deviation assessment. Coordinate mid- and long-term trading and spot trading. Based on the current operational needs and safety constraints of the current grid, the boundaries between the medium and long-term contract market and the spot market can be set on the first two days of the actual implementation date, taking into account that the inter-provincial involved entities can be appropriately advanced to three days before the implementation date. The medium and long-term contract market entered the spot market after the market closed. Spot transactions in the inter-provincial market can only be carried out until the day before and during the day, and the real-time transactions are not allowed for the time being, because the role of the inter-provincial market is mainly to promote resource flow and optimize the preparation, and the provincial market is responsible for the final balance. This process is also related to the current grid. The status of the operation is relatively matched. At present, medium and long-term contracts are a financial contract or a physical contract, and there is a big debate. In the initial stage of the market, individuals are more inclined to implement medium and long-term contracts as physical contracts. On the one hand, China's current electricity market is still a dual-track market, with a large proportion of planned electricity, and there is an objective connection between electricity planning and market transactions. If the medium and long-term contract is used as a physical contract, it is easy to connect with the current status quo, which is convenient for the market to start smoothly. On the other hand, market entities habitually regard medium and long-term contracts as physical contracts, using physical contracts to facilitate acceptance by market players, and more intuitively reflecting the will of market players. In addition, if all medium and long-term trading contracts are converted into financial contracts, a complete financial market system is needed to support them. The requirements for the market environment and credit system are high, and the market risks are high. Therefore, for the initial stage of China's power market, physical medium-long-term transactions plus spot adjustment deviations can be adopted, which can effectively guarantee the smooth start of the market and the effective participation of market participants. In the future, as the market develops and the market environment matures, the relationship between medium and long-term transactions and spot transactions can be gradually considered. In the specific market operation mode, the power trading center can provide a unified service window and service platform, and provide market registration services such as market registration, transaction declaration, information release, and transaction settlement for market entities. Considering the need for grid security and market transactions, medium and long-term transactions and spot transactions are organized and cleared by the trading center and dispatch center respectively. This will not only ensure the safe and stable operation of the grid and the effective development of market transactions, but also provide uniform, standardized and efficient services for market participants. Improve the level of renewable energy consumption. According to the current situation of renewable energy consumption, the inter-provincial market can promote large-scale consumption of new energy through cross-provincial trans-regional transactions. The provincial market should set a reasonable number of hours for new energy to be fully absorbed, exceeding some of the participating market transactions. Relevant measures are taken on the power supply side and the demand side respectively to promote the consumption of new energy through market mechanisms. First, cooperate with relevant state departments to establish a trading mechanism for clean energy quotas and quota indicators, clarify the obligations of clean energy consumption in various provinces, and further break the barriers between provinces. Combine the clean energy quota system with the index certificate transaction, combine the consumption obligation with the market mechanism, and promote clean energy consumption. The second is to establish a mandatory alternative mechanism for clean energy and optimize the congestion management of transmission channels. When clean energy conflicts with the national plan, the clean energy should be used to replace the thermal power sent by the national plan and compensated by the power generation transaction. Third, on the basis of reasonable determination of the guaranteed acquisition and utilization hours, encourage clean energy to exceed the part of the electricity to enter the market, and use its low marginal cost advantage to achieve priority consumption. The fourth is to improve and improve the bundling trading mechanism between renewable energy and conventional energy, and further clarify the responsibility and obligations of all parties and the specific operation methods of bundling, and provide conditions for the stable delivery of renewable energy. The fifth is to open up new energy consumption markets and expand the scale of pumping power of new energy and self-sufficient power plants and pumped storage power stations. Increase the substitution of electric energy, support the replacement of electric energy projects, participate in market transactions, and carry out trading of alternative energy sources such as new energy and regenerative electric heating. The sixth is to improve the inter-provincial transmission price mechanism, establish a price mechanism that is conducive to the promotion of new energy consumption, and study and establish a transmission price mechanism that is adapted to the overall optimization of the entire network. Improve the transparency and openness of the market. The key to improving market fairness and transparency lies in the disclosure of information. At present, the market entities are increasingly diversified, the types of information are more complex, and the regulatory requirements are continuously improved, which puts higher requirements on the information disclosure of power market transactions. The information disclosure requirements for electricity market transactions are comprehensive, timely and accurate, and the three frameworks should be improved. The first is the system framework, including the release content, release time, organizational system, management system, and support system. The second is the transaction information content framework, which defines public information for the public, public information for market entities, private information for specific market entities, institutions, etc., and exchange of information between market entities and trading platforms. The third is the information release process framework, which clarifies the division of labor and regulations for the entire process of information provision and information collection, information processing, information access and acquisition, and information dissemination. Improve market risk control capabilities. At present, there are five major risks in the power market, such as tight supply and demand risks, market forces to manipulate market risks, transmission resistance risks, credit risks, and regulatory and regulatory risks. The first is the risk of supply and demand. As China's existing electricity market construction is carried out under the circumstance of power supply and demand easing. When electricity supply and demand are tight, there may be an increase in electricity prices, which will have an impact on the returns of market players. In 2017, the sales of State Grid system increased by 7.5%, which is expected to be 5% this year, but the growth rate in the first quarter is faster. If the electricity sales continue to maintain rapid growth, there may be tensions in supply and demand in some areas in some areas. From the historical experience of China's power market development, tight supply and demand will often cause market construction to stop. Therefore, China's market base is still weak, and market risks need to be pre-judged and prevented. The supply and demand risks should be the top priority. The second is the market power risk. After the separation of the plant and the network, the competition pattern of China's power generation market has taken initial shape. At present, China's power generation enterprises have concentrated ownership, and many provinces have market concentration indicators of more than 1800. In the case of inadequate supervision, market forces' control and operation of market prices may have a greater impact on the market. Therefore, it is necessary to strengthen the market scope, strengthen the effective supervision of market power, build a reasonable market structure, encourage medium- and long-term power contracts, and introduce risk management tools such as power futures and options to weaken the risk of reducing market power. The third is the risk of resistance plugging. Compared with the mature foreign power market, the risk of transmission resistance in the construction of China's wholesale electricity market is more prominent. In addition, China's energy supply and demand are reversed, and large-scale and long-distance resource allocation needs are outstanding. The power transmission capacity of the power grid is still insufficient compared with demand. In the next step, the market entity should be guided to conduct transactions based on the channel capacity, establish rules for the use of transmission channels and transmission resistance plugs, and prevent the impact of transmission resistance plugs on the electricity market. The fourth is credit risk. The changing market structure brings credit risks that market participants may not perform or do not fully perform contractual obligations. Credit risk and price volatility often complement each other. Therefore, it is necessary to establish a market subject information disclosure system and a market subject transaction credit evaluation system, and strengthen credit risk management through blacklist systems, market credit rating systems, and big data analysis. The fifth is the regulation and regulation of risks, loopholes in regulation and regulation may become an important cause of fluctuations in the electricity market. Including unclear regulatory responsibilities of the parties, lack of clear administrative and law enforcement procedures, inadequate technical means of market supervision, and lack of binding mechanisms by regulatory agencies. According to the needs of future market development, we need to further sort out the power and responsibility boundaries of relevant power market regulators, establish and improve corresponding market supervision methods, and carry out rigorous and professional market supervision. Strengthen technical support for the power market. Figure 4 shows the composition of the national unified power market trading platform. At present, the basic applications and some advanced applications have all been realized. The next step will be to further expand the relevant applications according to market development. It is worth mentioning that the Beijing Power Trading Center and 27 provincial trading centers in the national grid operating area rely on this technical support system to realize the interconnection of data at the bottom of the trading platform, including data definition, data format, and data encoding. And the rules of interaction are all consistent, trading organization, data extraction, analysis and statistics are very convenient, effectively supporting the market operation of Beijing Power Trading Center and 27 provincial trading centers. National unified power market trading platform function module With the development of the market, Beijing Power Trading Center is actively researching and building a new generation of power market trading technical support system, focusing on the following four aspects: First, transform the current technology platform architecture into a cloud architecture and build a cloud platform; The second is to strengthen the analysis and mining of big data, service market transactions and credit system construction; the third is to study the technology of blockchain to ensure that the privacy of data can not be falsified; Fourth, the development and use of mobile APP can provide market participants More high-quality services, to facilitate market players to grasp market information and market declarations anytime, anywhere. (This article is based on the author's speech at the "2018 Economic Situation and Power Development Analysis and Prediction Conference".) This article is published in the "China Power Enterprise Management" 2018, 05, the author is the executive director and director of the Beijing Electric Power Trading Center.

CKB currency is the brand new upgrade of this small mining coin in the sales market in 2020. The first mining machine to release this currency is developed by Toddminer, a team of ToddMiner. They became interested in the new Nervos project in early 2019, and immediately invested their scientific research energy when the Nervos team released CKB's Eaglesong optimization algorithm. After 2 years, ibelink finally developed a 32T KDA machine emperor, and the price is affordable compared with KD6, cost-effective and stable pressure tube over KD6 head, and there are two ways to convert freely, emerald green way calculation rate is only 22T, but the function loss is reduced to 1850w, customers can choose the different way according to their own situation. As a new star in the mining circle, iBelink company's new implementation of BM-K1,BM-N1 is obligatory. BM-K1 mainly mines KDA coins, with a calculation rate of 5300G, a functional loss of only 800W, and a daily profit of 300+. And BM-N1 went up with 6.6T calculation rate to kill the small ant K5, ranked first.

Asic Miner IbeLink:iBeLink BM-K1 Max,iBeLink BM-K1,iBeLink BM-K1+

asic miner ibelink,ibelink miner,ibelink bm k1 max,bm k1 miner,ibelink kda miner Shenzhen YLHM Technology Co., Ltd. , https://www.hkcryptominer.com