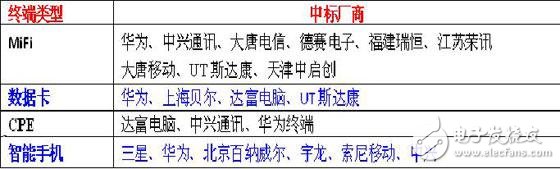

The second quarter of China Mobile's TD-LTE terminal collection, which has received much industry attention, has officially ended. The scale of this collection is about 200,000, including MiFi (about 150,000), data cards (about 30,000), CPE (about 20,000) and some TD-LTE mobile phones. The collection of 200,000 units is also an important part of China Mobile's TD-LTE "Double Hundred Plan". In September of this year, China Mobile will also start a larger scale of TD-LTE terminal centralized procurement, in order to be able to realize the centralized procurement of 1 million terminals within the year. According to insiders who participated in the bidding, China Mobile's TD-LTE terminal centralized procurement has caused a lot of confusion in the industry. The first is that China Mobile has changed the past measures of the Pratt & Whitney industry chain downstream, and once again interpreted the price to the extreme; secondly, Qualcomm ’s dominance in the chip field has not improved, and only HiSilicon has been selected among domestic chips; third, China Mobile has placed many indicators that are not very suitable for actual needs in an important position, such as a single-vote veto, which has rejected many domestic chip manufacturers. Collecting results: change and change Judging from the results announced by China Mobile, data card module products include Huawei, Shanghai Bell, Darfur Computer, UT Starcom and other four companies; MiFi module products include Huawei, ZTE, Datang Telecom, and Desai Nine companies including Electronics, Fujian Ruiheng, Jiangsu Rongxun, Datang Mobile, UT Starcom, and Tianjin Zhongqichuang were shortlisted; CPE module products included three companies including Tatfook Computer, ZTE, and Huawei Terminal; mobile phones Module products are shared by 6 companies including Samsung, Huawei, Beijing Binawell, Yulong, Sony Mobile and ZTE. Compared with last year's centralized procurement results, this year's TD-LTE centralized procurement results have two trends: one is that China Mobile's policy attitude towards each terminal manufacturer has changed significantly, and Pratt & Whitney has returned to price theory; the other is China Mobile's love for chip makers has not changed, and Qualcomm is still dominant. It is understood that in order to stimulate the development of the entire TD-LTE industry chain and allow more companies to participate, China Mobile changed its plan and adopted the inclusive policy during the centralized procurement last year. As many as 15 terminal manufacturers were shortlisted. Terminal manufacturers also have Taiwan-funded enterprises that have transformed from OEM. However, according to people familiar with the matter, this year China Mobile has returned to the old road of centralized procurement policies, and the one with the lowest price wins. Therefore, the number of shortlisted terminal manufacturers has declined: except for the expansion of mobile phone module products from 3 to 6 The number of data card module products has been reduced from 7 to 4, MiFi module products have been reduced from more than 10 to 9 and CPE module products have been reduced from 7 to 3. 1.6 years product warranty (material and workmanship), 25 years module power output warranty

3.Strong framed module, passing mechanical load test of 5400Pa to withstand heavier snow load 4.17% conversion efficiency,reducing installation costs and maximizing the kwh output per unit area.

Polycrystalline Solar Panel,Poly Panel,Poly Solar Panel Yangzhou Beyond Solar Energy Co.,Ltd. , https://www.ckbsolar.com

2.Industry leading plus only power tolerance: 0+3%