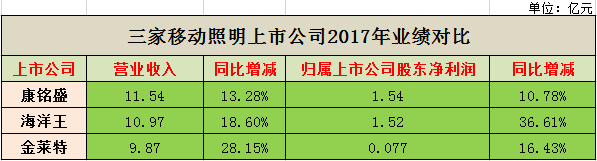

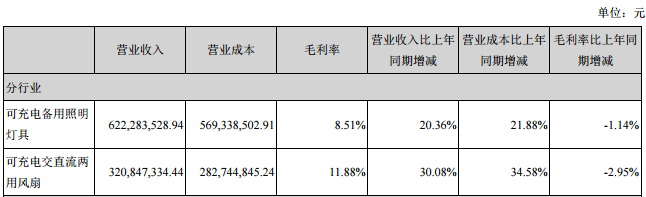

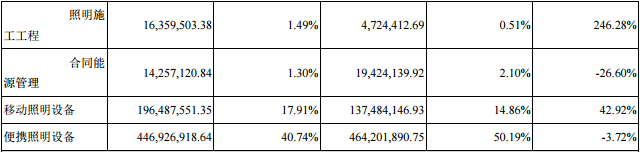

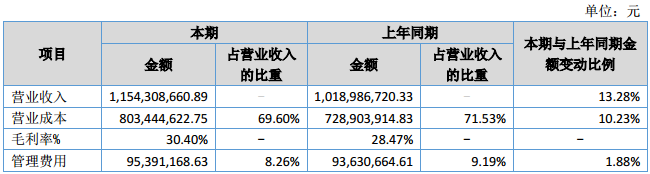

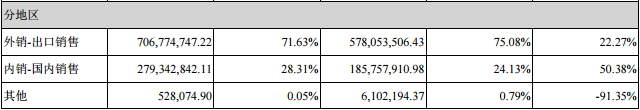

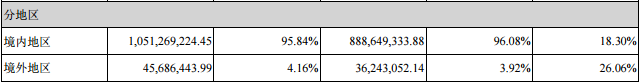

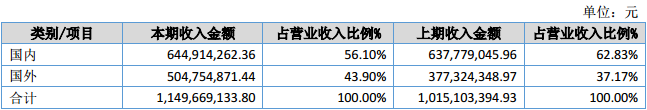

Up to now, the three listed LED companies, namely Kang Mingsheng, Ocean King and Jinlaite, which are mainly engaged in mobile lighting in China, have released the 2017 annual report. From the perspective of total revenue, Kang Mingsheng ranked first in the list of mobile lighting listed companies. In 2017, the total operating income exceeded 1.154 billion yuan, an increase of 13.28% over the same period of the previous year; the net profit attributable to the listed company shareholders was 154 million yuan, compared with the previous year. During the same period, it increased by 10.78%. First, from the perspective of growth, the three companies have achieved varying degrees of growth in terms of revenue and net profit. However, the previous weaker performance of Kinglet in 2017 was relatively strong in terms of operating income, ranking first among the three companies, while Ocean King's net profit increased the most. Second, from the perspective of product gross margin. Kang Mingsheng carried out in strict accordance with the business plan in terms of business operations, technological innovation, brand culture construction, etc., and its overall gross profit margin showed a slight increase year-on-year; while Jinlaite showed a weak decline in gross profit, showing a slight decline. In 2017, the gross profit margin of Jinlite's rechargeable standby lighting fixtures was 8.51%, down 1.14% year-on-year; the gross profit rate of rechargeable AC-DC fans was 11.88%, down 2.95% year-on-year. Jin Laite said that it is mainly because the state advocates supply-side reform at the policy level, and the prices of major raw materials continue to rise, and labor costs are high, resulting in a continuous decline in product gross margin. The gross profit margin of Ocean King mobile lighting equipment reached 17.91% in 2017, up by more than 3 percentage points; the gross profit margin of portable lighting equipment was 40.74%, down more than 9 percentage points year-on-year. Looking at Kang Mingsheng's gross profit margin, Kang Mingsheng's overall gross profit margin reached 30.40% in 2017, up nearly 2 percentage points from last year's 28.47%. In addition, from the product sales area. Jinlaite is still export-oriented, with export revenues reaching 707 million yuan, accounting for 71.63% of total revenue. However, with its efforts in the domestic market, its domestic sales reached 279 million yuan in 2017, accounting for 28.31%, an increase of 4 percentage points compared to last year. Contrary to Golden Wright, Ocean King is based on domestic sales. According to its annual report, Ocean Wang's domestic sales reached 1.051 billion yuan, accounting for 95.84% of total revenue; overseas sales were 406 million yuan, accounting for 4.16%. Among the three listed companies, Kang Mingsheng has the most balanced domestic sales and export sales. In 2017, Kang Mingsheng's overseas orders and sales grew rapidly, achieving foreign main business income of 505 million yuan, an increase of 33.77% over the same period of last year; realizing domestic main business income of 645 million yuan, an increase of 1.12% over the same period last year. It is understood that in 2017 Kang Mingsheng increased the development of overseas markets, especially in the area along the Belt and Road, accounting for about 82% of foreign sales revenue. For the future development of mobile lighting, the three listed companies have expressed optimism. Jin Laite said that the industry development of rechargeable emergency products will tend to pursue miniaturization and integration, and the downstream applications of products will become more extensive and product functions will become more diversified. The company will continue to explore the development, production and sales of rechargeable backup lighting and related products. Ocean King shows that although the competition in the special environmental lighting industry is becoming increasingly fierce, the company is also facing many new development opportunities. For example, the reform of state-owned enterprises will release many reform dividends, and the construction of the maritime powers and the strategy of the Belt and Road will drive fixed assets. The substantial increase in investment, the 13th Five-Year Plan, China Manufacturing 2025, and the Energy Development Action Plan 2016-2020 will bring opportunities to the company. Kang Mingsheng also bluntly said that the company will seize the market opportunities brought about by the transformation and upgrading of LED lighting consumption, continue to focus on the main business of LED mobile lighting products, take market demand as the guide, take technological innovation as the driving force, take brand management as the core, and do well Products, improve efficiency, optimize the diversified layout and output of sales channels, strengthen the investment and construction of e-commerce and overseas channels while strengthening and deepening the advantages of the company's distribution channels, and comprehensively enhance the company's operational quality and sustainable development capabilities. In summary, with the continuous improvement of the LED market penetration rate and the guidance of relevant national strategies, the prospects of the mobile lighting market are generally optimistic. OCTC Power Transformer, Solar Transformer, High Quality Solar Transformer, Solar Photovoltaic Transformer Hangzhou Qiantang River Electric Group Co., Ltd.(QRE) , https://www.qretransformer.com